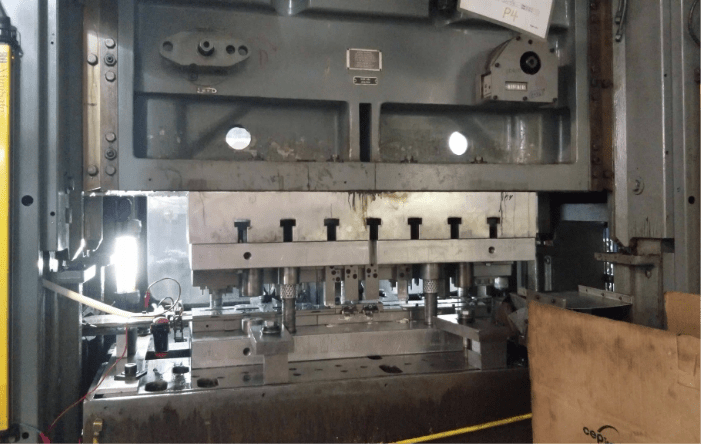

Click to Expand OEMs and their suppliers are always in search of the most economical way to produce high quality parts to specifications and on schedule. When it isn’t feasible to manufacture parts in-house, partnering with an experienced supplier is a smart choice. One process that companies frequently outsource is metal stamping, which is a…

Choosing a Progressive Metal Stamping Supplier

Your company has many options to choose from for progressive stamping projects. It’s worth your time to evaluate potential suppliers carefully as the level of expertise, service, or quality can vary. When looking for a stamping partner, consider a supplier’s quality, core capabilities, certifications and industry standards. Keep reading to see what you should be…

Electronics and Electrical Components for In-Home Security Systems

Feeling safe at home and knowing your home is secure while you’re away helps to keep our stress levels in check, giving us one less thing to worry about. For many, that means investing in a home security system. Though widely available and not a new technology, home security equipment has benefited from recent advancements…

Working With Alternative Materials: Consider Your Options for Stamped Components

By the time you’re ready to select a progressive stamper, your design is pretty well locked in, decisions about materials are made, and you’re ready to pull the trigger on production. Before doing so, it might be worth considering alternative metal materials or processes in the interest of saving money, time, or both. Won’t it…

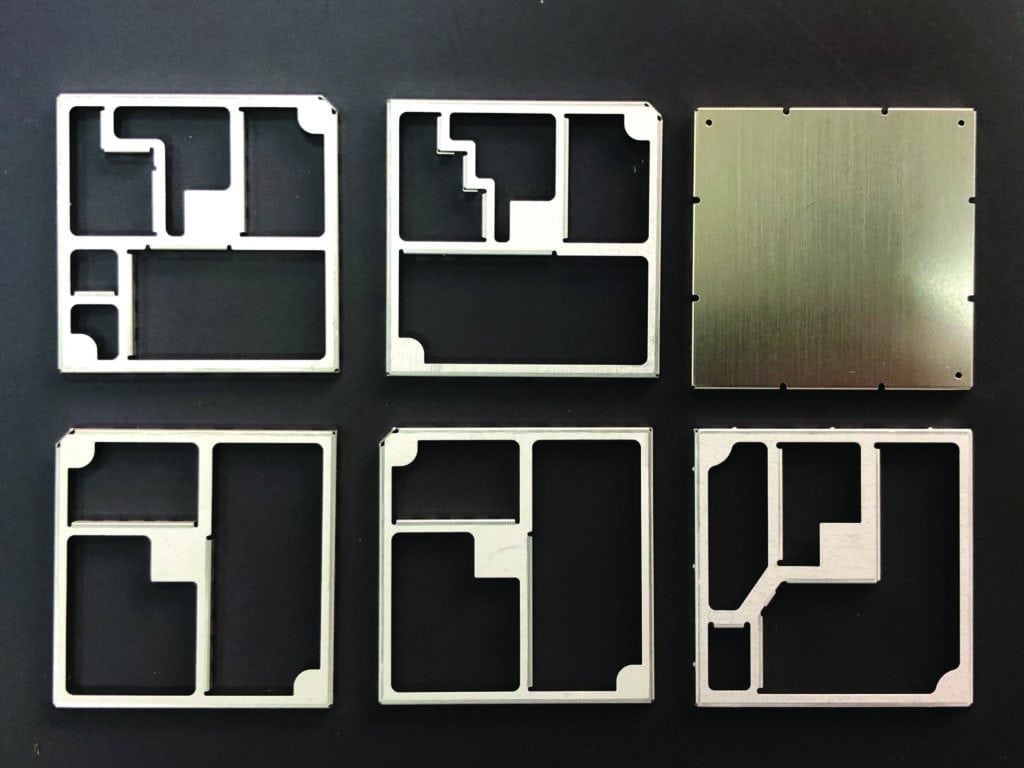

Progressive Die Stamping vs. Fine Blanking Operations

Choosing the Right Option for Your Next Stamping Project Having options in manufacturing gives you an advantage. Take the example of miniature and small metal components for automotive, medical, electronics, or other applications. Depending on tolerances and specs for a given project, you may have the choice of multiple methods that are similar but different…

Why EMI/RFI Shielding Techniques Are Important for EV & Hybrid Vehicles

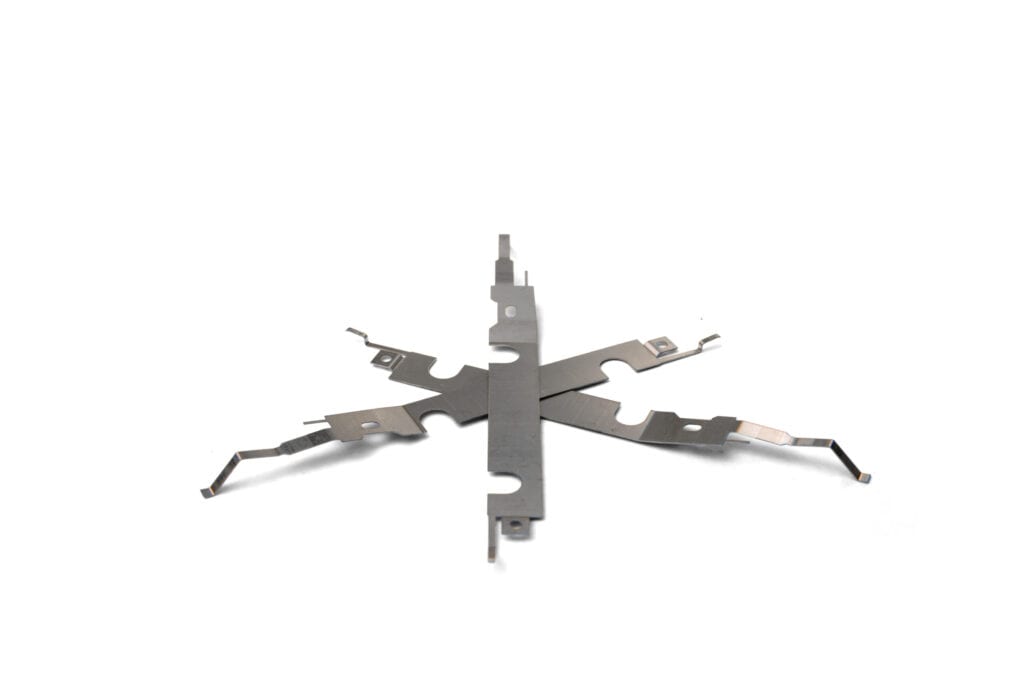

At CEP Technologies, we are a global source for miniature to small thin gauged progressive metal stampings, providing electromagnetic interference (EMI) and radio frequency interference (RFI) shielding solutions, electrical and automotive parts components, press fit pins, and more. EMI shielding protects electronic devices and equipment from signal disruption caused by external electromagnetic signals. EMI shielding…

The Ultimate Guide to Rapid Prototyping

By using prototyping tooling to make proof-of-concept and “functionally representative” units, CEP Technologies Corporation can shorten the time-to-market for our customers’ parts and products. Below, our team has put together a guide to rapid prototyping to help existing and potential customers understand the process, especially as it relates to metal stamping. It highlights what it…

What Shipping Containers Have to do With Global Logistics Challenges

If you’ve ordered products or materials for your business or home recently, chances are you had to wait longer than usual to receive them. Maybe you’re still waiting now. What’s going on?

Auto and Tech Converge: OEMs Use Software to Drive Innovation for EVs and Beyond

We’ve written before about the growing role of software and connectivity in the automotive space and the massive expansion in internal computing in vehicles. Computerized applications are used widely for both driving and safety features and for the V2X (vehicle-to-everything) user/consumer experience.

Auto Production Dips as Chip Shortage Continues

Let’s look at why the global semiconductor shortage continues to disrupt the auto industry as we near Q4, 2021.